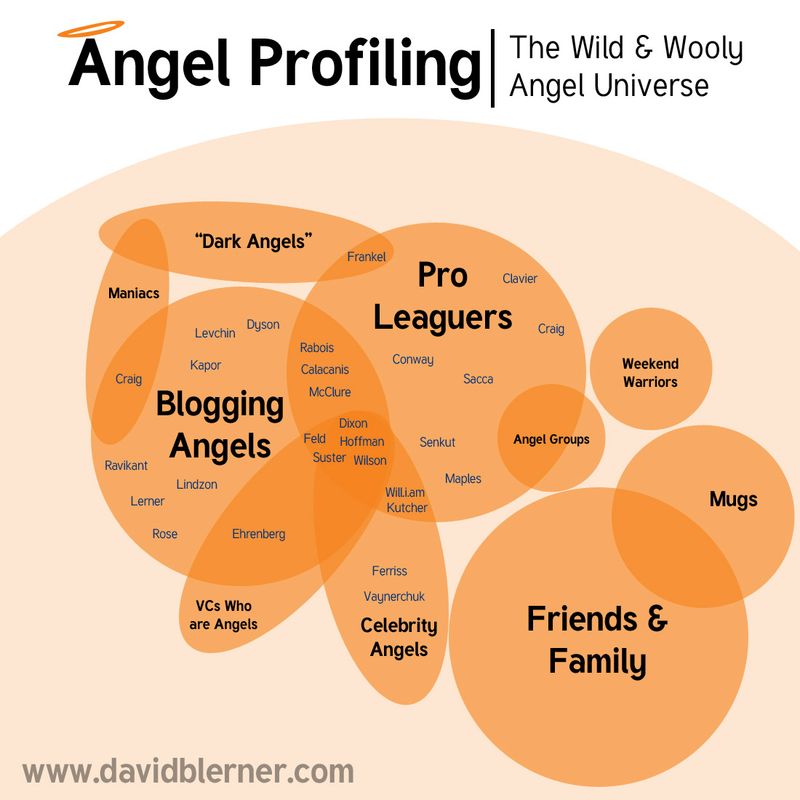

This is part of my ongoing Series on Angel Investing.

As promised in my last post I am compiling a list of Angel Investors who blog. Obviously this initial list is incomplete and has inaccuracies, so please help out by making suggestions and corrections.

You will note that not all of these blogs are about angel investing per se, as in many cases the blogs address the personal interests of the investors themselves which is consistent with our continuing exercise in Angel Profiling!

Click on this hyperlink to subscribe to my Global Directory of Blogging Angels.

PRO-LEAGUERS

Jeff Clavier (investor)

Chris Sacca (ex-googler, founder of lowercase capital)

Dave McClure (entrepreneur, 500 Hats)

Jason Calacanis (entrepreneur, ceo Mahalo, poker player)

Keith Rabois (entrepreneur, executive)

Chris Dixon (entrepreneur, co-founder Hunch, Founder's Collective)

Paul Kedrosky (investor, writer)

CELEBRITY ANGELS

Tim Ferriss (author of 4 Hour Work Week)

Kevin Rose (founder of Digg)

Will.i.am (musician, blackeyed peas)

Ashton Kutcher (actor)

ANGELS OF ALL KINDS

Max Levchin (entrepreneur, ceo Slide)

Bill Lee (entrepreneur, founder Remarq)

Naval Ravikant (entrepreneur, epinions, venturehacks)

Kevin Fox (entrepreneur)

Seth Goldstein (entrepreneur)

Auren Hoffman (entrepreneur, ceo Rapleaf)

Joshua Schachter (entrepreneur, founder Delicious)

Gabriel Weinberg (entrepreneur)

Shervin Pishevar (entrepreneur)

Jeremie Berribie (entrepreneur)

Brock Blake (founder Funding Universe)

Kimbal Musk (entrepreneur, founder Me.dium)

Mitch Kapor (entrepreneur)

Howard Lindzon (entrepreneur, founder Stocktwits)

Joi Ito (entrepreneur, founder, Creative Commons)

Alexander Muse (entrepreneur)

David Rose (founder AngelSoft, NY Angels)

Esther Dyson (ED Venture Holdings)

Dave Lerner (entrepreneur, Columbia Venture Lab)

David Tisch (NY Tech Stars)

Roger Ehrenberg (IA Ventures)

Gary Vaynerchuk (entrepreneur, WineLibrary TV)

Pat Matthews (entrepreneur, founder of webmail.us)

Micah Rosenbloom (entrepreneur, co-founder Brontes, Founder's Collective)

Caterina Fake (entrepreneur, Flickr, Hunch)

J. Basil Peters (angel investor)

Michael Parekh (investor)

Travis Kalanick (entrepreneur)

Stephen Gill (entrepreneur)

Eric Paley (entrepreneur, Founder's Collective)

Roy Rodenstein (entrepreneur, founder Going)

Jeff Miller (entrepreneur, founder Punchfork)

David Shen (product guy, former Yahoo)

Kip McClanahan (entrepreneur, TippingPoint, 3Com)

Dave Nakayama (former Yahoo)

Will Herman (entrepreneur, Innoveda, Viewlogic Systems)

Bill Boebel (entrepreneur, webmail.us, Rackspace)

Marco Messina (entrepreneur)

JS Cournoyer (entrepreneur)

VC's WHO DO ANGEL INVESTING

Fred Wilson (Union Square Ventures)

Mark Suster (GRP Partners)

Brad Feld (The Foundry Group)

Roger Ehrenberg (IA Ventures)

John Frankel (FF Asset Management)

For Part 3 of this mini-series, click here.