This is part of my ongoing Series on Angel Investing.

Mark Suster, one of the best VC bloggers out there, recently put out his own five-part series on Angel Investing. As usual, (despite running a big VC fund, Launchpad L.A., hosting This Week in Venture Capital and being a family man), this latest series of his was totally comprehensive and got to the very heart of the subject. As one who has been an angel since 2001 and an author of my own much more primitive series on the subject, I devoured Mark's efforts and had much the same experience as Howard Lindzon- who likened reading these posts to being on a roller-coaster ride!

Prior to the posting of his recent series, I always got a kick out of Mark's various off-the-cuff comments about Angel Investing in which he referred to it as a "Mug's Game". I knew from first-hand experience what he was talking about but it wasn't until he authored his series that he elaborated on this general opinion. Anyway, he lays out five major pre-requisites for becoming a great angel investor. Without the following, Mark is essentially saying- you are either sh*t-out-of-luck or a plain Mug. (yes, this is meant to be tongue-and-cheek).... Here they are:

- Access to the best dealflow... (being at the "right poker table")

- Possessing the requisite domain knowledge

- Having strong relationships with VC's

- Possessing deep pockets (so you can follow-on and avoid being crushed)

- Having access to the eventual buyers of these companies

He is no doubt correct, though I pointed out to him that one also needs to account for a wide swath of angels who are involved for different reasons. He agreed and elaborated on this towards the end of this post.

Anyway, his series and our exchange inspired me to provide you with a fuller picture of the angel community. Therefore, in this mini-series of my own I intend to elaborate on the subject of angel investing and to give fledgling angels and others interested in this space the opportunity to learn more about who we are, (it's extremely varied and diverse!), how you become an angel, and what the general options are in this landscape.

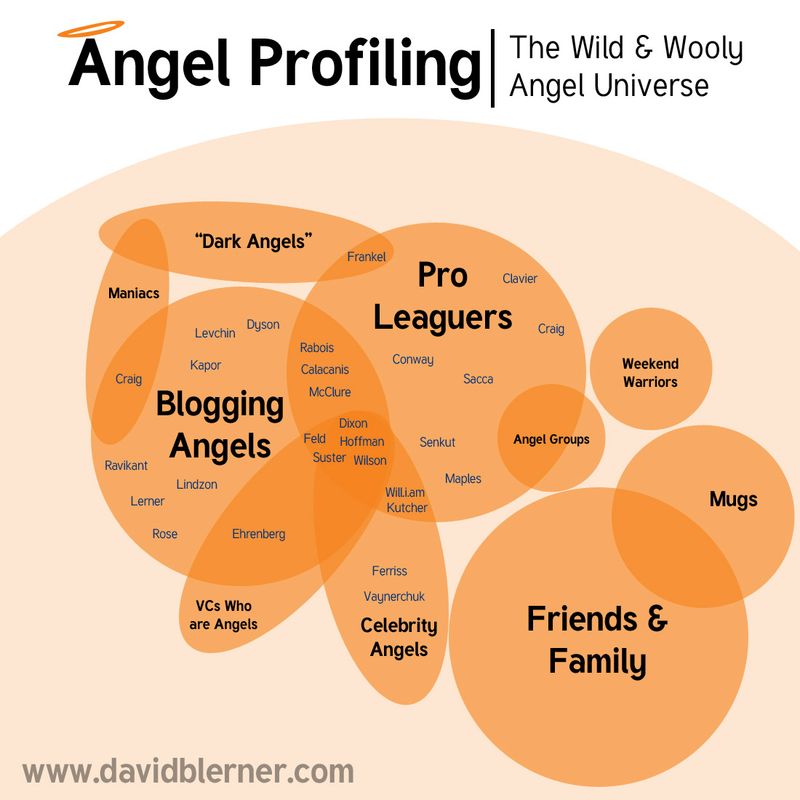

So let's commence some Angel Profiling, shall we?

To begin, cast your eye over the photos above that headline this post and in the upper levels you will see the faces of some of the "pro-level guys" as I call them. Many of these guys all have the qualities and attributes that Mark laid out in his series, which, for reference purposes, we'll call the "Susterian qualities". I'm talking about Ron Conway, Aydin Senkut, Mike Maples, Jason Calacanis, Jeff Clavier, Chris Sacca and others. Just in the last few days some of these elite "super-angels" have been accused by TechCrunch's Michael Arrington of holding secret gatherings in order to collude and drive deal terms in the Valley. Dave McClure denied it here, but Ron Conway, who was not at the dinner, unleashed on some of his fellow elites with this email TechCrunch recently got ahold of. The press is calling this fascinating episode: AngelGate!

But who are the people in the photos on the bottom row below? No doubt, here are the "Mugs" that Mark refers to... I, for example, am the guy getting his ass kicked in the bottom right-hand photo and the people "cramming me down" are some venture capitalists joined by some angry co-investors on a British deal circa 2001 when I first got started.

(yes- any first-time readers- (and Mom perhaps)- I am kidding...)

The reality is that angels come in all sizes and shapes and with varying motivations and goals. There is actually massive diversity in our ranks. Are there some Mugs among us? Sure there are. I was one myself when I got started no doubt. Are there some maniacs out there as well? Damn right there are! But there's a whole swath of angels in the middle, many of whom have a good idea of what they are doing and why they are doing it and, though not in the pro-leagues- are "in control of themselves" so to speak. Here are some News Flashes for you that the mainstream press hardly ever takes note of:

- Not all angels live in Silicon Valley!

- Not all angels are interested in consumer internet companies!

- There are vibrant angel communities in NYC, Boston and in other cities around the US!

- Angels account for 90% of all start-up funding in the US!

- Angels put up $20 Billion a year into approximately 50,000 startups!*

- Friends & Family put up an estimated $60 Billion a year into startups!*

- There are an estimated 225,00 angels in the United States*

- There are currently ~300 active angel groups in the United States*

*Source: Angel Capital Association

Furthermore, Angels have all kinds of reasons and motivations for investing. You can pretty much categorize us as follows:

- Friends and Family supporting "our own"

- "Mugs" who don't know what the heck they are getting into and don't realize it (me circa 2001)!

- Maniacs Tilting at Windmills (who don't know what they're doing, realize it, and don't care)

- "Weekend Warriors" of varying skills and motivations, (this includes participants in Angel Groups)

- Entrepreneurs Giving Back and supporting the younger generation

- Celeb Angels (Ashton Kutcher, Will.i.am, etc.)

- VC Angels (VC's who do some angel investing on the side)

- Professional Angels (the pro-leaguers I have mentioned above)

In the coming mini-series I am going to round-out this fascinating landscape with various posts which will include but are not limited to a map of the overlapping and concentric circles of the angel landscape, a list of angels who blog, and a description of the ones I call the "Dark Angels". Stay tuned!

For Part 2 of this mini-series, click here.