This is part of my Series on Angel Investing.

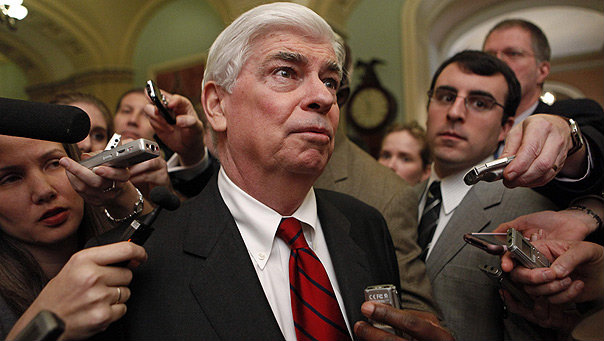

There is a rather large missile rapidly approaching America's innovation culture. Predictably, it has been hurled in the most careless of manner by a group of uninformed politicians and their staffers in the form of Senator Dodd's sweeping Banking Bill. Putting aside the merits and thrust of the Bill itself, (which ostensibly seeks to regulate the banking industry), there are two provisions in it which, if not removed ASAP, will essentially wipe out a large chunk of one of America's engines of innovation- namely angel investing. These provisions will raise the bar on the definition of an 'accredited investor' from $1M in net worth or $250K in annual income to $2.3M in net worth or annual income of $450K! It will also hamstring angel investing by slapping any such investment with a 120 day SEC review.

If this concerns you, you may want to call your congressmen and educate them on this issue.

For more in depth condemnation of these stupendously destructive provisions, I refer you to the following cacaphony of frustrated voices emanating from the startup and investment community:

Venture Beat: Angels Sing: Frankly Ridiculous Restrictions Might Destroy Silicon Valley

NY Times: Angels Rebel Against Dodd Bill

Kopelman: Dodd Isn't on the Side of Angels... or Startups.... It Proposes a 120 Day SEC Review Period

Litan: Proposed 'Protections' for Angel Investors are Unecessary and Will Hurt America's Job Creators

Xconomy: Dodd Bill Could Render Startups Too Small to Succeed

TechDirt: Why Does Financial Reform Punish Startups and Angel Investors?

Wilson: Startups Get Hit by Shrapnel in the Banking Bill

Shane: How Dodd's Reform Plan Hurts Startup Finance

For the next post in this Series, click here.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=e0d938e5-b776-446a-a18b-d58564d82187)